Please select from one of the following

RESIDENTIAL CONVEYANCING INTRODUCTION

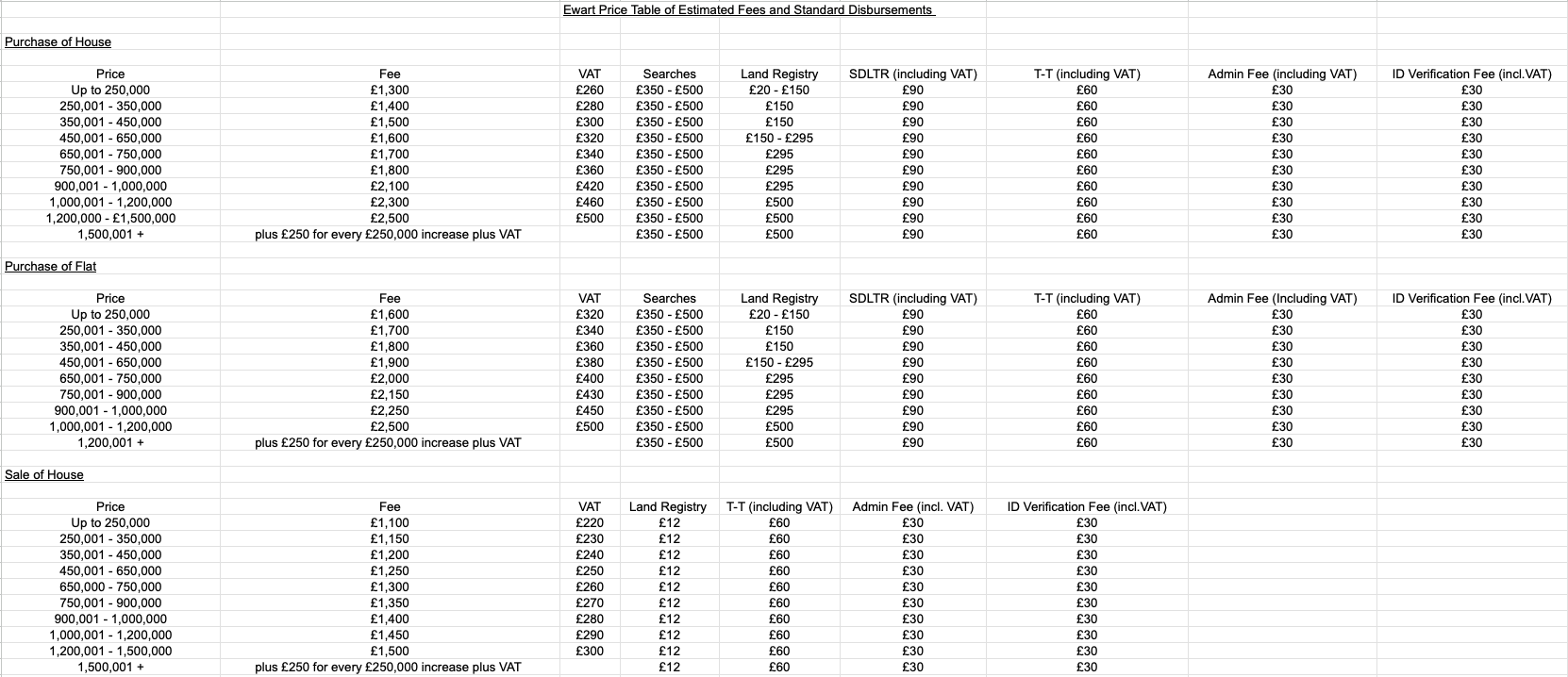

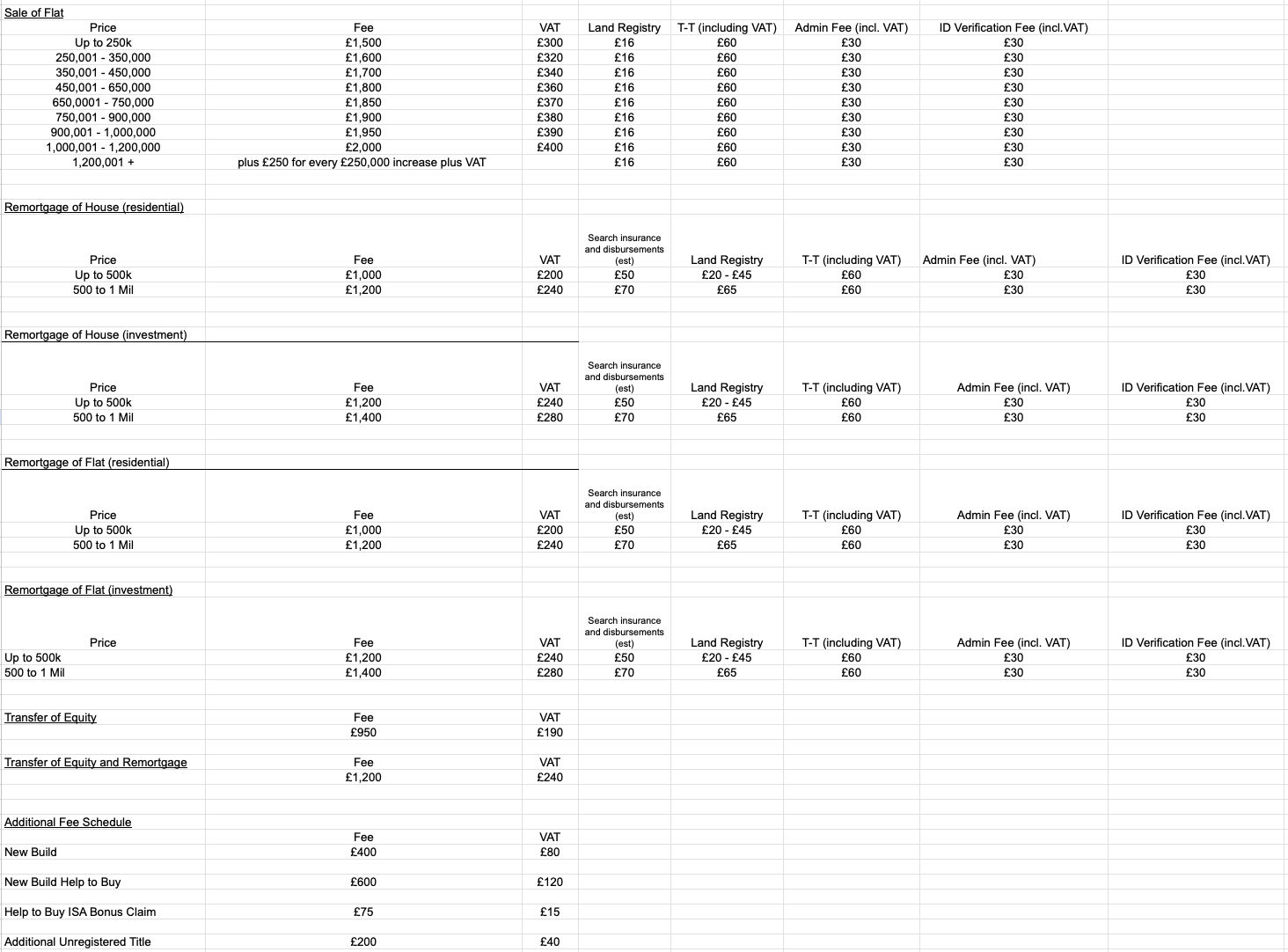

Welcome to the Ewart Price fees and disbursements summary. Please complete the appropriate questionnaire and we will be pleased to provide you with an estimated budget for your transaction.

Please bear in mind this budget is subject to review depending upon the circumstances that arise in the transaction. You will see we have given some explanation on the sorts of factors involved separately. We are always happy to discuss these further with you.

Although price will be a factor in deciding which lawyer you wish to act for you, you will also want an idea of the service you will receive. A good service can reduce the stress of conveyancing transactions and can even save you money in the long run.

Ewart Price are committed to providing our clients with a high level of service and a local presence. Please consider the following when making your decision:-

- We are members of the Law Society CQS Scheme, a protocol for residential conveyancing to help speed up and produce high standard levels in a transaction.

- We are a firm of solicitors regulated by the Solicitors Regulation Authority and have a high level of professional insurance to protect our clients.

- You will have a qualified and experienced Solicitor or Licenced Conveyancer to primarily act for you who will be contactable on a direct dial telephone line.

- We are based in a prominent position in Welwyn Garden City which has easy access and parking which enables letters and documents to be collected and returned if easier for clients or if the transaction is urgent.

- We invite all clients to meet with us at least once during your transaction to ensure you understand the process and have the opportunity to ask questions.

- We have a very high level of client satisfaction, clients returning to us for further transactions and recommending us to family and friends.

WHEN ADDITIONAL FEES MAY BE PAYABLE

We have or will be very happy to provide you with an estimate of our anticipated fees and expenses for acting for you. However, in exceptional circumstances, the transaction may prove to be substantially more complex or time-consuming than we can reasonably anticipate at the present time and we reserve the right to review our estimate in such cases.

There may be additional work required separate from the main transaction which will be charged for independently. The following are examples with estimated fees (VAT to be added):

Electronic ID checks (if we have not acted for you before) £20 per client Money Transfer fees usually £50.

Preparation of Stamp Duty Land Tax Return from £50 Power of Attorney from £50.

Statutory Declaration from £50.

Preparing or dealing with gift certificates where a gift is made to help purchase £75 Claiming Help to Buy ISA bonuses £50 per claim.

Declaration of Trust from £100.

Landlord’s Deed of Covenant or Licence from £100.

Arranging an undertaking for keys/access between exchange and completion £75 Arranging a legal indemnity policy from £50.

Obtaining files from storage and copying TBA

There are also other examples of factors that will affect the work involved and the likely fees. For example, if there have been alterations to the property without all appropriate consents being obtained (this may include building regulation approval, planning permission, consent under freehold covenants or landlords consent under leasehold covenants).

If the property is leasehold, problems can occur with short Leases (under 80 years remaining), high ground rent (above £200 per annum) or if the Lease provides unreasonable rent reviews (for example other than increasing by the Retail Price Index).

Also we do not generally deal with purchasing shared ownership properties or Help to Buy mortgages. If there were particular circumstances where we did, then there would be additional fees payable for dealing with these types of transactions.

If you are purchasing in the name of a Company there is likely to be additional work than buying in a personal name. This may include preparing Board Resolutions, arranging execution of Debentures, registering mortgages at Companies House, undertaking company searches etc.

We will therefore usually charge an additional fee of at least £100 plus VAT together with the additional disbursements.

If the property you are buying or selling is a House in Multiple Occupation (HMO) there will be a number of additional issues to review, for example multiple tenancy agreements, planning issues, HMO licence requirements etc.

If the transaction does not proceed to completion, our charges and expenses will be based upon the work undertaken and payments made up to that point. In any event our charges in the event of an abortive transaction will never exceed the original quote for costs given at the outset of the transaction (as amended, if at all, during the course of the transaction).

Please also bear in mind that the fees quoted to you at the outset of your transaction relate to the conveyancing work only. Disputes may arise as a result of breach of contract for example by your buyers or sellers. We will be happy to advise you on such matters, but we shall charge you separately for such work.

WHEN ADDITIONAL DISBURSEMENTS MAY BE PAYABLE

“Disbursements” are payments we make on your behalf during the course of your transaction, such as Stamp Duty Land Tax, Land Registry fees and the cost of searches.

There may also be other payments which need to be made on your behalf. Some common expenses include indemnity policy premiums if there is a defect of title or missing documentation or failure to obtain appropriate consents for alterations.

A new lender may impose a fee for telegraphing the mortgage monies to us. An existing lender may charge administration fees for releasing the title deeds or closing a mortgage account.

If you are purchasing or re-mortgaging a leasehold property, the Lease may dictate what fees are payable to the Landlord or Management Company on registration of your purchase or mortgage. There may be a number of payments required to be made to the Landlord, managing agents or a management company for their supplying documentation or other information necessary to the transaction such as Licence to Assign or Deed of Covenant.

During the course of the transaction, the documentation and information that we provide to you should indicate when such additional disbursements may become payable.